Consumer and Purchasing Behavior in Health & Fitness: The Health Spending Paradox

Insights from building Welltory—with citations, research, and uncomfortable truths

After years in this market, watching genetic testing companies pivot from health insights to ancestry entertainment, and seeing wearables evolve from revolutionary health tools to expensive step counters, one pattern remains constant: the fundamental disconnect between who media says buys health products and who actually opens their wallets.

I watched the genetic testing gold rush firsthand. Companies raised billions promising health insights, but 23andMe discovered the majority of their business was ancestry curiosity, not health optimization. People wanted to know if they were 2% Viking, not their disease risk.

At Welltory, we've cycled through multiple positioning strategies—from premium biohacking service at $99/month with personal health analysts, to ear-clip wearables, to cognitive optimization courses. Each pivot taught us something counterintuitive about health consumer behavior.

Here's what killed our premium coaching model: you need thousands of trained specialists who understand both data analytics and preventive health. Doctors don't learn this. Wellness coaches can't interpret HRV patterns. There's no talent pipeline. But the deeper realization was more unsettling: executives weren't motivated by long-term health risks at all. What actually worked? Showing them how stress and recovery influenced their productivity, decision-making, and ultimately—their income. Money and performance were stronger motivators than mortality.

The most striking revelation: nobody wakes up thinking about preventing a heart attack in 10 years. This creates a fascinating market dysfunction where acquisition messaging and retention reality exist in parallel universes.

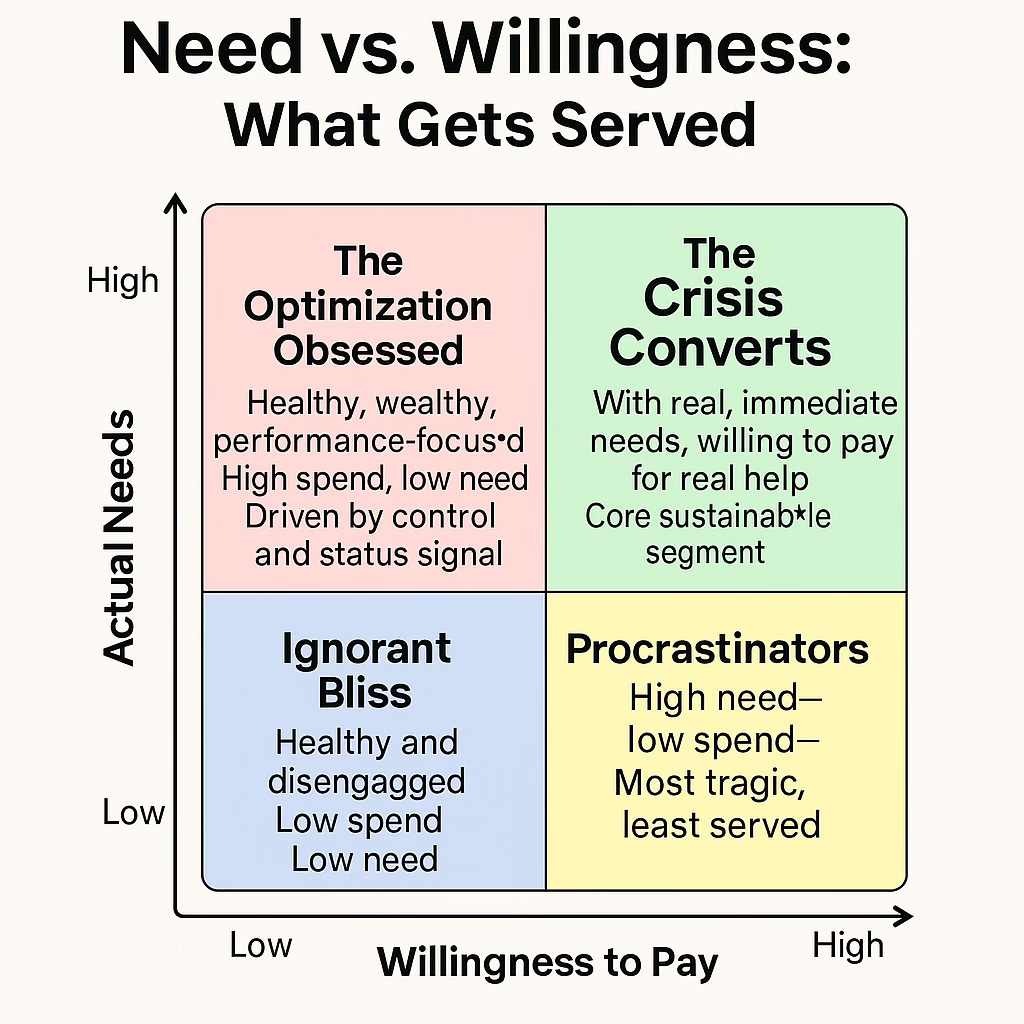

The Health Spending Paradox Matrix

After analyzing thousands of customer behaviors, I've identified four distinct consumer archetypes based on their actual health problems versus their willingness to spend:

The Optimization Obsessed (High Spend, No Real Problems)

These are the Bryan Johnson disciples, the crypto traders on nootropics, the 25-year-olds with continuous glucose monitors despite perfect health. They spend $50-500 monthly not because they need to, but because health optimization has become their identity.

What drives them isn't health—it's status signaling within performance communities and the illusion of control over biological processes. They generate massive media buzz but represent a tiny fraction of actual market revenue.

The Crisis Converts (High Spend, Real Problems)

This is where Welltory found product-market fit. Typically 45-65 years old, these customers have experienced their first chronic diagnosis or health scare. They don't care about biohacking buzzwords—they want to understand why their energy crashed after COVID, why their sleep went to hell during menopause, or how to manage their new diabetes diagnosis without becoming their diabetic parent.

Our median customer is around 50, not the 25-year-old wellness influencer posting sunrise yoga shots. They stay for years because we're solving actual problems, not manufactured anxieties. They're willing to pay $50-150/month for genuine help because the alternative—watching their health decline like their parents' did—finally became real.

Ignorance is Bliss (Low Spend, No Problems)

Most healthy young adults fall here. They'll download free apps, maybe try meditation during a stressful week, but fundamentally believe health problems happen to other people. They represent the largest population segment but generate the lowest revenue. You can't sell prevention to people who don't believe they need preventing.

Research shows young adults aged 19-25 have the highest per capita healthcare expenditures at $1,935, yet exhibit suboptimal healthcare utilization patterns with high emergency room usage (15%) but low office-based visits (55%).

The Procrastinating Patients (Low Spend, Real Problems)

The tragic majority. These people know they have problems. They've googled "why am I tired all the time" at 3 AM. They've researched every thyroid supplement. They've read 47 reviews of continuous glucose monitors. But psychological barriers—analysis paralysis, temporal mood regulation—prevent them from actually purchasing solutions. They need help the most but are psychologically least equipped to seek it.

The Media Myth vs. Market Reality

While tech media obsesses over crypto traders microdosing and Bryan Johnson's $2 million annual regimen, the actual data tells a completely different story:

Who Really Pays for Digital Health

Women dominate every metric:

38.88% more likely to wear fitness trackers than men

49% more likely to use healthcare wearables

54% of fitness tracker owners are women aged 35-54 with household incomes $100k+

Women ages 19-44 spend 58% more on healthcare than men ($9,989 vs $8,313 annually)

Working-age women account for $985 billion in total healthcare spending

Income matters more than age:

31% of households earning $75,000+ use wearables

Only 12% of households earning under $30,000 use them

Income brackets $75k+ are 3.21x more likely to purchase wearables

The disconnect exists because different devices serve different purposes. Men buy smartwatches (71% male, ages 18-34) for tech and status. Women buy fitness trackers for actual health management. One is a gadget market, the other is a health market.

Interestingly, the male grooming market reached $61.3 billion in 2024 with men increasingly adopting wellness categories traditionally dominated by women, yet this spending is more about appearance and status than health outcomes.

The Economics of Irrationality

Here's a brutal truth from research: prevention often costs more than treatment. A wellness program preventing one heart failure case among 100 people at $400/month costs $960,000 but saves only $22,000 in treatment costs.

Yet people continue paying. Why?

The Control Illusion Premium

Health anxious individuals—5.7% of the population—spend $857-$21,137 annually not for health improvement but for perceived control. They'll pay $300/month for continuous glucose monitoring despite perfect metabolic health, while avoiding $20 copay preventive visits.

This psychological dynamic explains the market's dysfunction. Apps exploiting anxiety can charge $70/month for generic meal plans because users buy for emotional relief, not behavior change. The global supplement market exceeds $150 billion annually despite weak evidence for most products—people buy the feeling of "doing something" about their health.

The "Fleece and Forget" Economy

These "fleece and forget" models have doubled our customer acquisition costs. Here's how they work:

Promise magical "AI-personalized health transformation"

Charge $70-150/month for generic content anyone could Google

Blow $100+ acquiring each customer

Profit from the 3-4 months before they remember to cancel

Rinse and repeat with fresh victims

They can afford astronomical marketing budgets because they're not selling health—they're selling the momentary dopamine hit of "doing something about your health."

Hidden Markets and Taboo Spending

The research uncovered massive unreported spending in categories people don't discuss:

Productivity Enhancement (Not Health)

$200-500/month on ADHD medications without diagnosis

6.7% of workers use "productivity drugs" (up from 4.7%)

Critical insight: These drugs improve motivation and energy, not actual cognitive capacity

Sexual Health

61% improvement in erectile function drives willingness to pay

Taboo nature creates price insensitivity—people pay premium for discretion

Medical Aesthetics as "Health"

$25.88 billion market growing at 12.8% annually

81% more open to procedures vs 5 years ago

79% of surgeons report demand driven by social media appearance

Life Stage Triggers That Override Economics

First Chronic Diagnosis Impact

Research tracking 3,297 participants over 9 years found that chronic disease creates lasting financial perception changes. Individuals become 22% more likely to report inadequate resources and fundamentally shift spending from optimization to crisis management.

The Sandwich Generation Crisis

23% of adults simultaneously care for aging parents and children. This creates:

Extreme price insensitivity for time-saving health services

Guilt-driven spending on others' health over their own

The Personalization Paradox

UCLA research revealed that despite claiming privacy concerns, users' payment behavior showed no negative correlation with data sharing. The paradox is strongest among young males who verbally express privacy concerns while behaviorally sharing extensive health data.

Price elasticity of personalization:

Basic willingness to pay: $6.50/month

With AI personalization: $149-299/month

With genetic integration: $199 initial + $69/year

With biomarker analysis: up to $1,500/year

The CPI Crisis: How Market Distortions Compound

Our cost per install doubled, driven by multiple compounding factors:

iOS Privacy Tax: 73.2% CPI increase post-iOS 14.5

Fraud Ecosystem: $84 billion growing to $172 billion by 2028

Category Premium: Health apps have highest revenue per install

Professional ASO Arms Race: 3x conversion rate advantages

Market Concentration: Winner-takes-most dynamics

When apps monetizing anxiety can outspend those providing value, legitimate businesses get priced out of growth.

The Uncomfortable Truths

After years watching this market evolve, several patterns have become undeniable:

Nobody is financially incentivized to keep people healthy—not insurance companies, not pharma, not even individuals until crisis hits.

The loudest segments aren't the most valuable. Bryan Johnson's $2 million annual anti-aging crusade makes for great headlines but represents 0.0001% of the market. Those Gaming Discord biohacking servers where gamers debate nootropic stacks? They generate Twitter threads, not revenue.

Real customers don't match startup pitch decks. Our median customer is ~50 years old, motivated by genuine health issues, not optimization fantasies. They're not there for "biohacking" or Instagram-worthy transformation photos. They come—and stay—because they finally need real help managing chronic fatigue, understanding their cardiac risks, or navigating menopause. And here's the kicker: they actually pay for it.

Marketing messages and product value live in different universes. We still use "Heart Rate Monitor" as our App Store title despite no long-term customer describing us that way. Acquisition requires anxiety triggers; retention requires real solutions.

Market Implications

The pattern is clear: money flows to those who understand psychology, not physiology. The most profitable health apps aren't making people healthier—they're monetizing the gap between people's health anxieties and their behavioral realities.

Sustainable businesses are building for Crisis Converts with real needs, while venture-funded growth stories chase the Optimization Obsessed with their high visibility but low lifetime value. The market currently rewards exploitation over care. Quality startups trying to create real value are priced out of acquisition channels by products that profit from abandoned good intentions.

In a market where nobody is financially incentivized to create healthy people—not insurers, not pharma, not even the people themselves—perhaps the most radical position is simply trying to do so anyway.

But here's what keeps me going: those 50-year-olds who finally found us after years of searching for real answers. They don't care about our App Store optimization tricks or growth hacking. They care that we're still here, still improving, still trying to bridge the gap between what health tech promises and what people actually need.

The winners won't be the loudest apps in the charts. They'll be the ones that figured out how to turn a broken market's incentives into sustainable value—without losing their soul in the process. I know many great founders who work on products like that and I hope that together we will be able to find the right balance between psychology and physiology.

Great insight! Many thanks.